TABLE OF

CONTENTS

- Disclosures

- Property Information

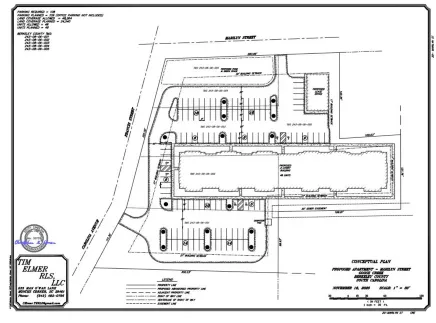

- Site Plan

- Investment Summary

- Investor Structure

- Financial & Assumptions

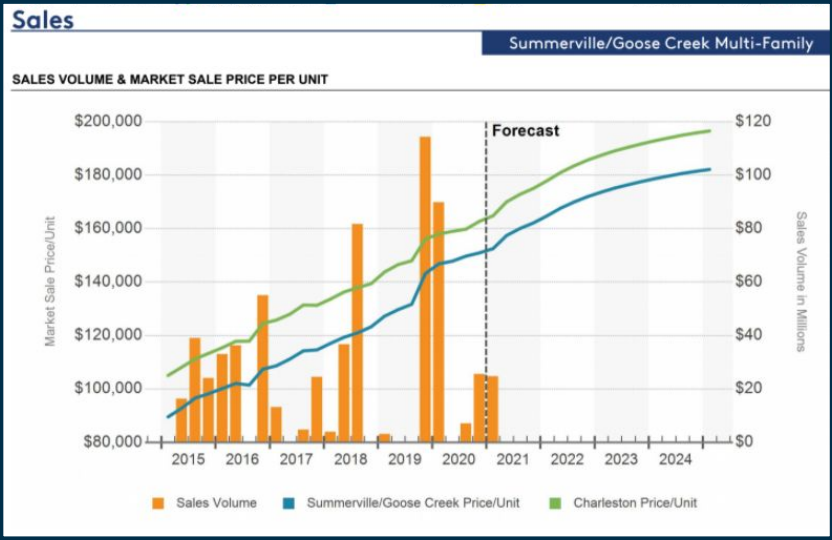

- Market Position - $ / door

- Market Position - Cap rates

- Area Map

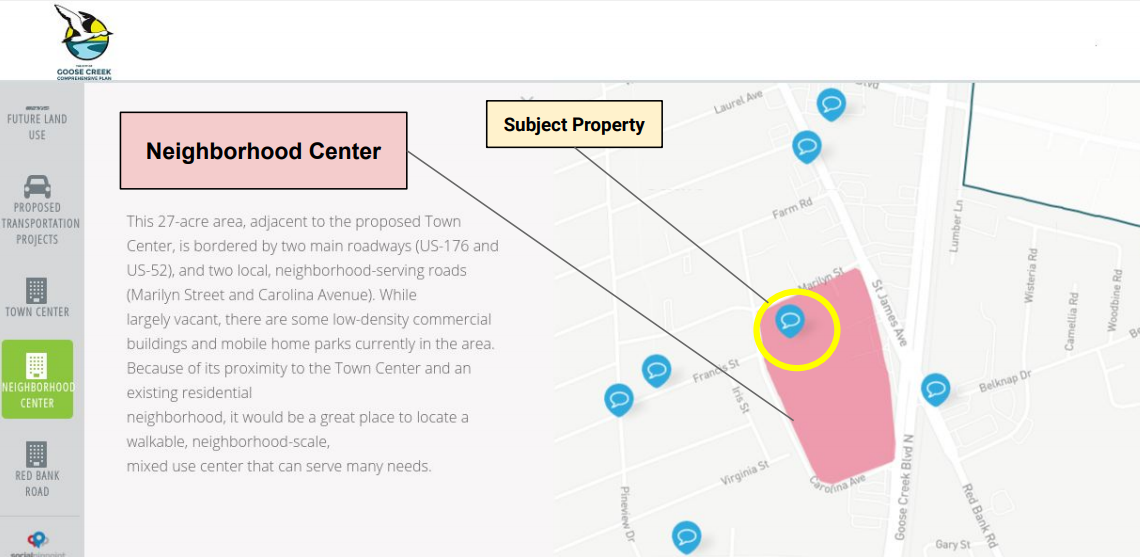

- City Comprehensive Plan

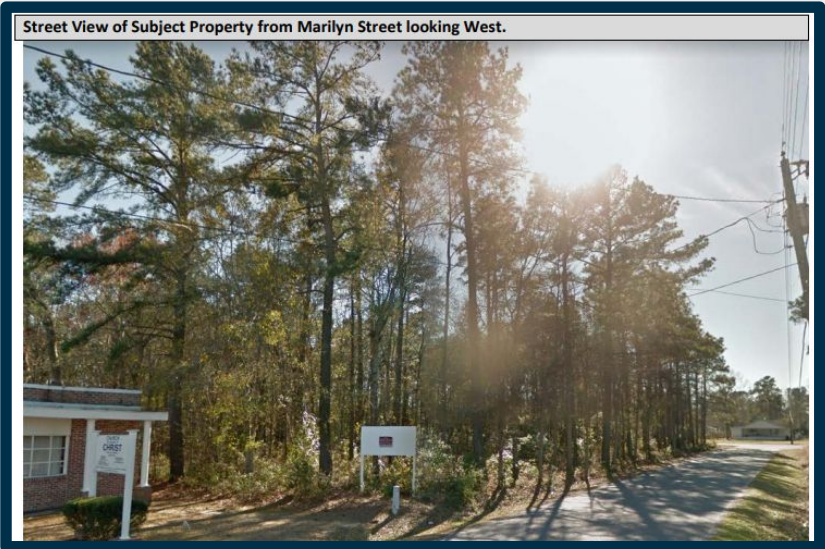

- Location views

- Surrounding Activity

Rockrei Real Estate

Frans Calderon

wealthproperties7@gmail.com

(843) 647-8159

DISCLOSURES

Rockrei and Gloucore are the sponsors/developers of Marilyn Apartment Homes. All materials are of a confidential nature, intended for use by a limited number of parties, and furnished solely for the purpose of procuring the investment capital for the Property described herein. You agree that you will hold and treat all provided materials in the strictest confidence.

No representation is made by Gloucore as to the accuracy or completeness of the information contained herein and nothing contained herein is or shall be relied on as a promise or representation as to the future performance of the Property. The information contained within has been obtained from sources that we deem reliable, and we have no reason to doubt its accuracy; however, no warranty or representation expressed or implied, is made by Gloucore or any related entity as to the accuracy or completeness of the information contained herein. Prospective investors are expected and encouraged to exercise independent due diligence in verifying all such information. We include projections, opinions, assumptions, or estimates for example only, and they may not represent current or future performance of the property. You and your tax and legal advisors should conduct your own investigation of the property and transaction.

Gloucore expressly reserve the right, at their sole discretion, to reject any or all expressions of interest regarding the Property and/or terminate discussions with any entity at any time with or without notice.

INVESTMENT SUMMARY

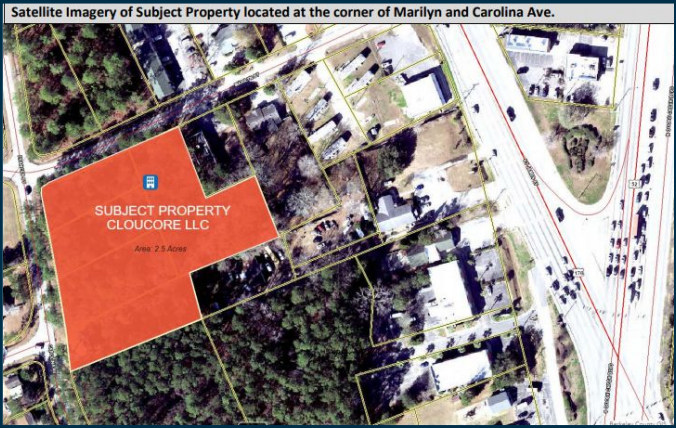

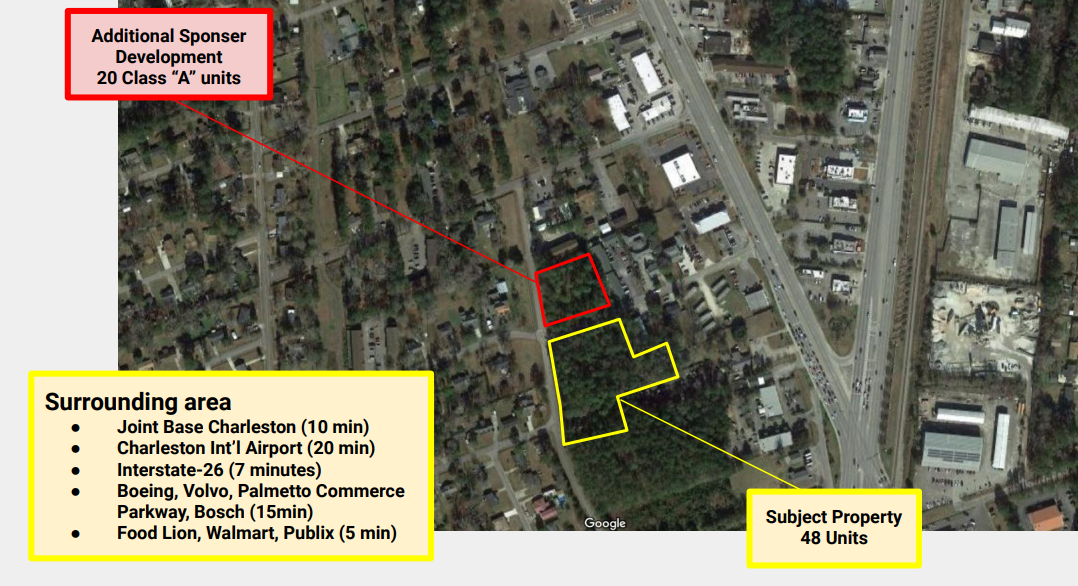

Rockrei and Gloucore (“sponsors”) have identified 5 parcels in the Charleston MSA for the new development of 48 apartments to be named Marilyn Apartment Homes. Marilyn is planned to be developed as class “A” apartments and will be located in the thriving submarket of Goose Creek, South Carolina.

At a total projected cost of $5.6M, sponsor will add value and save on cost by directly managing and employing the ground-up development/construction team. Similar assets on the market have an average per unit sale price of $155k.

The sponsor has partnered with AdaLease Property Management, a leader in quality asset management services in growth markets for the Southeast. AdaLease has over 30 years of experience in real estate investments and focuses primarily in the multifamily space. AdaLease brings further confidence to the deal by being located in South Carolina and through its expertise in this region.

The sponsors anticipates to return investor equity, plus a preferred return, upon stabilization through a cash-out refinance. A single-purpose LLC will be formed to hold the asset and a limited partnership will be formed to constitute investor capital.

*all investor investment details will be contained in the offering memorandum.

PROPERTY INFORMATION

- 48 Units

- 1 Structure

- 109 Parking spaces

- 2 Bed / 2 Bath

- Unit size 940sf

- Berkeley County

- City of Goose Creek

- 2.77 Acres

- Central HVAC

- Adjacent to Neighborhood Center

SITE PLAN

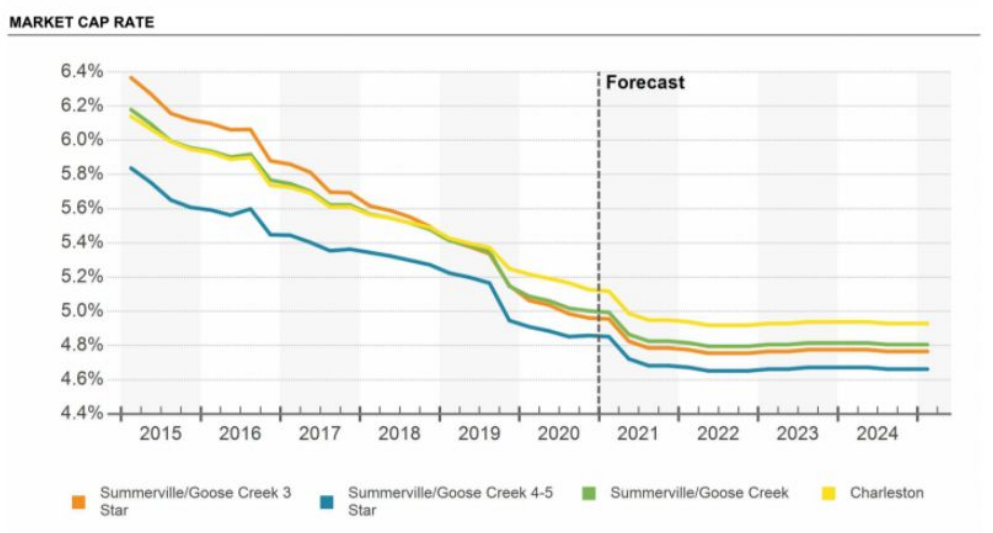

MARKET POSITION

*Sponsor is assuming market cap rate + 50 basis pts to scale for smaller asset size

AREA MAP

CITY COMPREHENSIVE PLAN

*Sponsor is assuming market cap rate + 50 basis pts to scale for smaller asset size

CITY COMPREHENSIVE PLAN

*Sponsor is assuming market cap rate + 50 basis pts to scale for smaller asset size

Meet The Rockrei Management Team

Matt Sotiroglou

Builder

FRANS CALDERON

CEO

MARKET POSITION

$150k+ / unit

Projected Investor Returns

A two-tiered return structure gives investors more choices when placing their equity. Investors have the opportunity to invest in either tier of equity Class A, Class B or a combination of both Class A and Class B. Diversifying in both classes allows for a risk adjusted and blended return.

Projection

Investment: $ 100,000

Projections

Investment: $ 100,000

Year

Annual Return %

Annual Gain $

1

9%

$90,000

2

9%

$90,000

Year

Annual Return %

Annual Gain $

Capital earned on sales or refinanced in two years

1

7%

$7,000

2

7%

$7,000

$ 33,928

Total return

Total return %

$ 47,929

47.93%

* See the investor offering memorandum for more details including the sensitivity analyses.

INVESTOR STRUCTURE

Upon distributable cash flow, investors will first receive an preferred 7% return on their outstanding equity balance. Then, cash flow from operations in excess of the 7% hurdle will be distributed 70% to investors and 30% to sponsors.

On capital events, such as a refinance or sale, proceeds are first distributed 100% to investors until all investors receive 100% of their unreturned capital plus the preferred return. Sponsor is second to receive 100% unreturned capital plus the preferred return.

Limited Partners: $10,000 total minimum investment with a 7% preferred return on invested equity,

*please review all investor investment details in the offering memorandum.

FINANCIALS

ASSUMPTIONS

REQUEST ACCESS

TO THE EXCLUSIVE